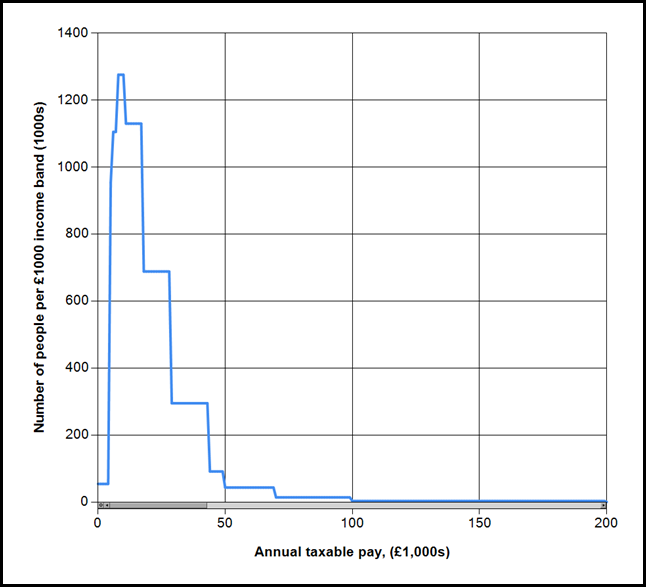

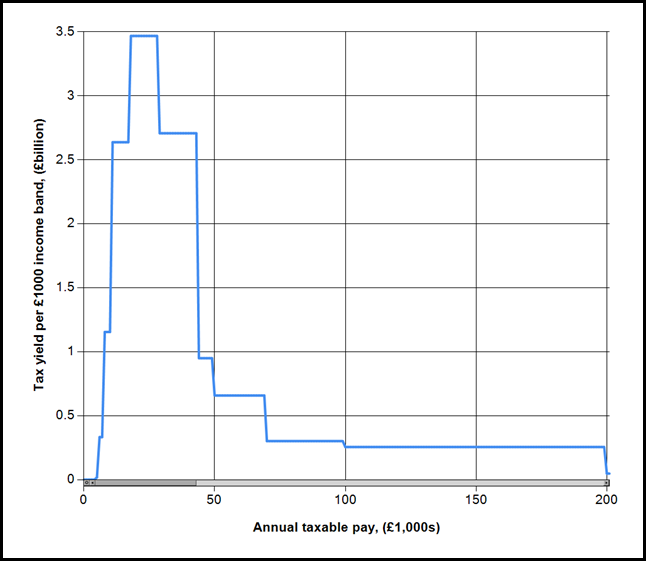

In my last blog post I calculated how to raise money for various things (getting rid of tuition fees, avoiding any benefit reductions and so forth) using income tax; originally the more ranty bit to be found in this post was included, but it was getting a bit long so I separated analysis and rant.

Since the election there’s been a great deal of discussion of cuts, largely this has been framed in terms of a cut to X being apocalyptic where X is some area supported by its interest group. There has been rather less focus on what should happen in place of such cuts, proposing an alternative area for increased cuts has generally been tried: “waste, foreigners in the form of international development, benefit scroungers, Trident“ are ever popular – each of these contributes about £1bn or so per annum in spending – the gap we’re trying to match is about £80bn per annum. There have been some proposals for increased taxes to be paid by “someone else”, an increase in VAT met with considerable opposition (VAT is the third biggest element of tax – the change would raise about £13bn per annum), as was an attempt to cut child benefit for higher rate tax payers, raising about £2.5billion per annum.

The favoured targets for increased taxes are “the rich” and “tax avoidance”. “The rich” are normally defined as “richer than me and the people I know”, which is a poor definition. Tax avoidance, according to an HMRC report under the last government the size of the tax gap – the sum of avoidance (legal) and tax evasion (illegal) was around £40bn per annum. This is disputed with Tax Research UK giving a figure three times larger at £120bn. It’s difficult to see exactly how they manage such a high estimate – it’s seems to be based around the size of the “shadow economy” – things like illegal working. Regardless of this actually collecting the money involved in the tax gap would appear to be difficult: as announced by Danny Alexander there’s a hope that spending £200million per year will result in a tax recovery of £7bn per year. There’s an implicit assumption in tax avoidance that again it’s “the rich” who are responsible but it seem clear from reading the HMRC document that successfully addressing the tax gap would probably impact quite broadly. For example, buying wine in Calais is a tax avoidance; as is paying the builder, decorator and so forth in cash; as is purchasing items in Hong Kong via ebay. The company I work for has changed the way it pays some of my pension contributions to reduce the tax paid – presumably this would count as a tax avoidance too.

Vodafone is in the news at the moment for a £6bn tax avoidance. The £6bn figure is as calculated by Private Eye and is described by HMRC as “an urban myth”; Vodafone appears to have made provision of £2.2bn to address this issue and ultimately paid £1.25bn. It’s worth pointing out that the £6bn figure, accrued over 10 years is typically compared by protestors with a *yearly* benefit cut of £7bn. This sort of presentation leads me to believe that the proposer is somewhere on the innumerate-dishonest scale and discount whatever else they are saying. Taking the Private Eye “high” estimate this is £600million per year, taking the difference between the amount actually paid and the “low” estimate it amounts to £100million per year. Vodafone appears to have paid around £1bn tax on profit in 2009 amounting to a rate of 25% in that year, so it is not true that they pay “no tax”. It’s also worth noting that Vodafone appear to have the legal upper hand in the situation, given a judgement in the European Court of Justice.

At one time Trident or its replacement were cited as a source of ready cash – again the presented cost of up to £100bn is for the entire lifetime of the system of up to fifty years or so i.e. between £1bn and £2bn a year, regardless of this the decision on Trident has been pushed into the future (i.e. beyond the next election). A more likely figure for the Trident replacement is £20bn, or at most £34bn. I’ve said previously that I consider Trident to be Cold War willy-waving but scrapping it is not a big impact – particularly if there is any sort of replacement.

A useful rule of thumb for all these situations seems to be:

- Check that tax gain and spending are being compared on the same time period.

- Divide quoted tax gain by at least three since that will get you back to a more generally accepted figure.

The latest wheeze is chasing George Osborne for a £1.6million tax bill. Referring to our list above, (1) is met admirably this bill would be payable once, on the death of his father. Experience suggests the figure of £1.6million is fanciful. David Mitchell puts this so much better than me here in the Observer. It’s not that I am in favour of tax avoidance I just see efforts to address the problem by individual harassment as pointless. What is needed, as Mitchell points out, are changes in the law so that tax avoidance becomes tax evasion and is then illegal. It’s ridiculous to expect people to pay tax that they don’t legally have to – it’s not what the great majority of the population do – why expect companies and the rich to do any different?

I’ve yet to see any figures on the “cut deficit through growth scheme”, a priori I’m dubious since the ability of government to influence growth seems marginal and any scheme would need to stretch out beyond the 10 years that even Labour were planning to cut the deficit in by which time using my state-of-the-art recession prediction algorithm we will have experienced another recession, and another addition to the deficit.

I’m uncomfortable with the idea that we should demand services (no tuition fees, protected benefits) but rather than seeking a way to contribute to paying for these services personally try to push the payment for them onto a small fraction of the population. If you demand more money for X but don’t expect to pay any more for it then frankly I don’t think you’re committed to the idea.